Why Your Business Is Losing Money Without a Modern POS System

Running a business without a modern Point of Sale (POS) system may seem manageable, but in reality, it’s costing you more than you realize. From hidden labor expenses to lost sales and compliance risks, the true cost of manual operations adds up quickly. While investing in a modern POS may feel like a large expense, the return on investment is undeniable once you understand the financial impact of outdated systems.

In this article, we’ll uncover the hidden costs of manual business operations and show you why switching to a modern POS system in 2025 is one of the smartest financial decisions you can make.

Labor Costs: The Silent Payroll Drain

Labor is often 25–35% of retail expenses, and manual operations inflate those costs significantly.

- Slow transactions: Manual price calculation and payment processing take 2–3 times longer than automated POS systems.

- Training overhead: New employees need weeks to learn outdated processes, compared to hours with an intuitive POS.

- Inventory management: Staff waste countless hours counting stock and updating spreadsheets manually.

- Double data entry: Entering the same data into multiple systems creates inefficiency and errors.

👉 Example: A business handling 100 transactions daily wastes over 1,800 staff hours per year due to slow manual processes. At just Kes15/hour, that’s Kes27,375 lost annually.

2. Inventory Shrinkage: The Profit Killer

Poor inventory tracking leads to shrinkage rates up to 5%, much higher than the retail average of 1.4%.

- Unknown losses remain hidden until physical counts reveal discrepancies.

- Overordering ties up capital in excess stock.

- Stockouts drive customers straight to competitors.

- Carrying costs like storage, insurance, and tied-up capital eat away at profits.

👉 Example: On Kes500,000 in annual sales, 4% shrinkage equals Kes20,000 in losses. A POS system can reduce shrinkage to industry averages and save Kes13,000 annually.

3. Revenue Losses from Inefficient Operations

Manual processes don’t just cost money—they lose sales:

- Long checkout times: 75% of customers leave if they wait more than 5 minutes.

- Pricing errors: Undercharging just Kes0.50 per sale equals Kes18,250 lost yearly for 100 daily transactions.

- Limited payment options: Cash-only operations drive away 7% of potential sales.

- Missed upselling opportunities: Without customer purchase history, employees can’t suggest complementary items.

👉 Example: Losing just 5% of potential customers due to limited payment options can cost over Kes22,813 per year.

4. Customer Retention Challenges

Customer acquisition is expensive—5 to 25 times more than retention. Manual systems make retention harder:

- Poor service experiences due to slow or error-prone processes.

- No loyalty programs without customer tracking.

- Lack of insights on purchase patterns and preferences.

- Inconsistent experiences across employees or locations.

5. Compliance and Risk Management Costs

Manual operations also put you at risk of costly mistakes:

- Tax errors lead to penalties and interest.

- Audit expenses rise with poor record-keeping.

- Fraud & theft risks increase in cash-heavy businesses.

- PCI non-compliance fines for unsafe card processing can exceed Kes5,000 monthly.

- Higher insurance premiums for businesses with poor security.

6. Technology Debt: The Cost of Delay

Every month without a modern POS system increases your technology debt:

- Competitors pull ahead with efficiency and better customer experiences.

- Delayed integrations become more complex and expensive.

- Staff resistance grows as they become used to manual systems.

- Missed opportunities for growth, analytics, and smarter decisions pile up.

The Real Cost of Not Having a POS

Here’s what a small business could lose annually without a modern POS system:

- Excess labor costs: Kes27,375

- Inventory shrinkage: Kes13,000

- Pricing errors: Kes18,250

- Lost sales (payment limits): Kes22,813

- Customer retention losses: Kes15,000

- Compliance & risk costs: Kes5,000

👉 Total hidden costs: Kes101,438 per year

Meanwhile, a POS system typically costs Kes1,200–3,600 annually. That’s up to 85x cheaper than the price of staying manual.

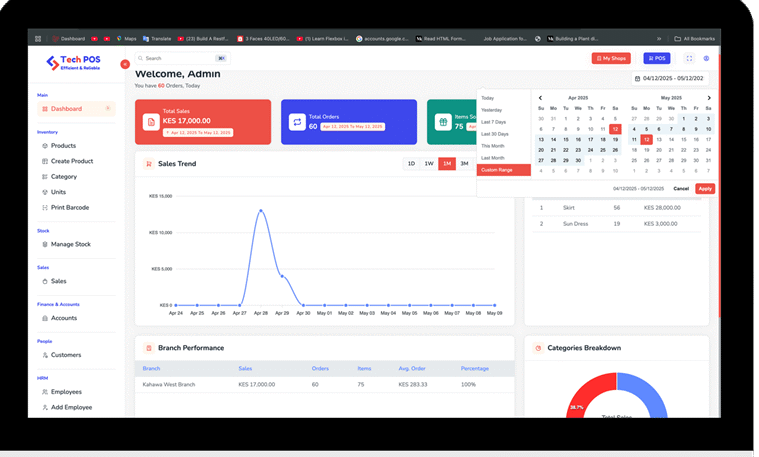

Why You Should Invest in a POS System Now

A modern POS system pays for itself within 3–6 months by:

- Automating transactions and reporting

- Reducing shrinkage and inefficiencies

- Boosting sales through faster checkout and upselling

- Improving customer retention with loyalty programs

- Providing real-time analytics for data-driven growth